商业银行信号卡业务潜在客户识别的研究

摘要摘要对于国内银行业来说,飞速增长的信用卡业务将成为银行利润的重要来源,信用卡客户的营销工作也受到了越来越多的重视。由于银行营销工作面对的客户众多,竞争日益激烈等方面原因,数据挖掘技术越来越多地被应用到信用卡营销领域,并将成为支持银行信用卡市场分析和提高营销效率的重要工具。而经过十多年的研究,数据挖掘技术已较为成熟,因此近年来研究的重点转为挖掘技术的应用,商务作为数据挖掘的主要应用领域,对知识的需求尤为显著。面对巨大的市场压力,竞争状态主要表现为企业间对最有利客户的激烈争夺上。因此潜在客户识别的研究具有重要的现实意义。本文采用数据挖掘技术,旨在利用数据挖掘技术对商业银行进行客户挖掘,依据历史...

相关推荐

-

上海市民办上宝中学2020-2021学年八年级下学期3月月考英语试题(原卷版)

2024-10-14 25

2024-10-14 25 -

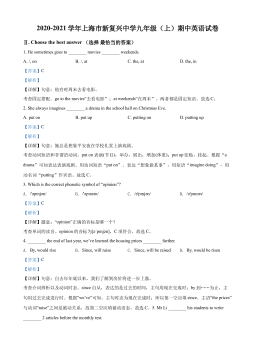

上海市民办新复兴初级中学2020-2021学年九年级上学期期中英语试题(解析版)

2024-10-14 25

2024-10-14 25 -

上海市民办新复兴初级中学2020-2021学年九年级上学期期中英语试题(原卷版)

2024-10-14 29

2024-10-14 29 -

上海市民办新复兴初级中学2021-2022学年八年级下学期期中英语试题

2024-10-14 30

2024-10-14 30 -

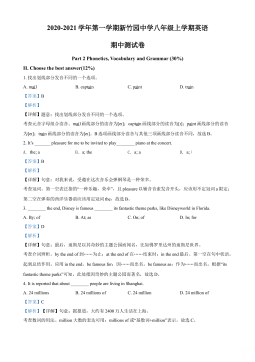

上海市民办新竹园中学2020-2021学年八年级上学期期中英语试题(解析版)

2024-10-14 32

2024-10-14 32 -

上海市民办新竹园中学2020-2021学年八年级上学期期中英语试题(原卷版)

2024-10-14 25

2024-10-14 25 -

上海市闵行区2017届九年级4月质量调研(二模)英语试题及答案(word解析版)

2024-10-14 25

2024-10-14 25 -

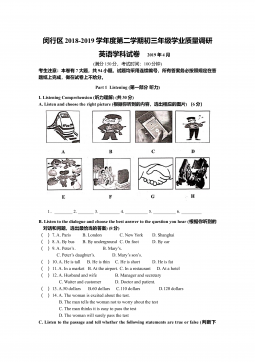

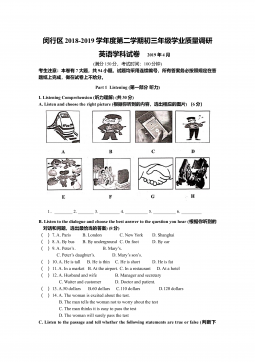

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(解析版)

2024-10-14 30

2024-10-14 30 -

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(原卷版)

2024-10-14 30

2024-10-14 30 -

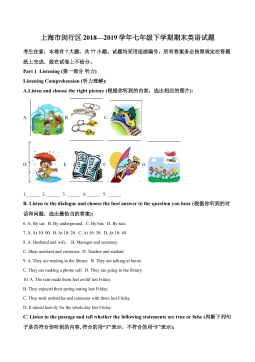

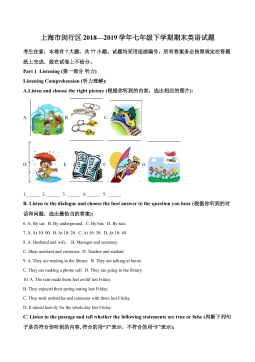

上海市闵行区2018—2019学年七年级下学期期末英语试题(解析版)

2024-10-14 33

2024-10-14 33

相关内容

-

上海市民办新竹园中学2020-2021学年八年级上学期期中英语试题(原卷版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOC

价格:12 积分

-

上海市闵行区2017届九年级4月质量调研(二模)英语试题及答案(word解析版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOCX

价格:12 积分

-

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(解析版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOCX

价格:12 积分

-

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(原卷版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOCX

价格:12 积分

-

上海市闵行区2018—2019学年七年级下学期期末英语试题(解析版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOC

价格:12 积分