我国税收流失对经济社会的影响与对策

我国税收流失对经济社会的影响与对策摘要随着经济体制改革的不断深入,市场经济的发展,我国的税制改革也取得了明显的成效。但是,由于我国受税制条件、税收成本、公民纳税意识普遍淡薄等因素的制约,税收流失现象还依然存在。税收流失作为税收征管当中的难题,一直在困扰着税务工作者,同时也威胁着国家经济的持续发展。本文首先指出课题研究背景,然后分析税收流失概念,之后从税收流失对财政状况的影响、对市场经济秩序的影响、对社会稳定的影响三个角度来研究税收流失对经济社会的影响,然后从制度因素和社会因素分析分析我国税收流失的原因分析,最后从以完善税收制度为基础,优化现行税种、以健全税法体系为根本,实现依法治税、严厉打击税...

相关推荐

-

上海市民办上宝中学2020-2021学年八年级下学期3月月考英语试题(原卷版)

2024-10-14 25

2024-10-14 25 -

上海市民办新复兴初级中学2020-2021学年九年级上学期期中英语试题(解析版)

2024-10-14 25

2024-10-14 25 -

上海市民办新复兴初级中学2020-2021学年九年级上学期期中英语试题(原卷版)

2024-10-14 29

2024-10-14 29 -

上海市民办新复兴初级中学2021-2022学年八年级下学期期中英语试题

2024-10-14 30

2024-10-14 30 -

上海市民办新竹园中学2020-2021学年八年级上学期期中英语试题(解析版)

2024-10-14 32

2024-10-14 32 -

上海市民办新竹园中学2020-2021学年八年级上学期期中英语试题(原卷版)

2024-10-14 25

2024-10-14 25 -

上海市闵行区2017届九年级4月质量调研(二模)英语试题及答案(word解析版)

2024-10-14 25

2024-10-14 25 -

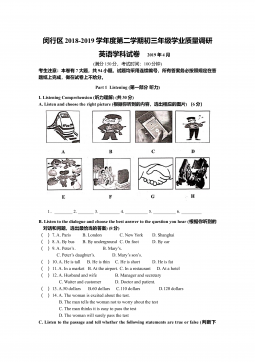

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(解析版)

2024-10-14 30

2024-10-14 30 -

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(原卷版)

2024-10-14 30

2024-10-14 30 -

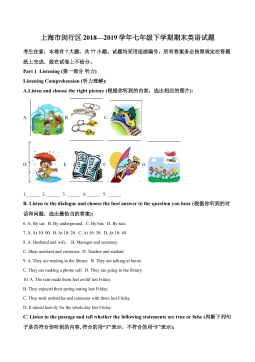

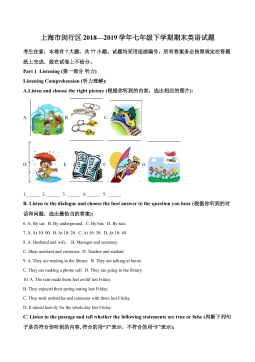

上海市闵行区2018—2019学年七年级下学期期末英语试题(解析版)

2024-10-14 33

2024-10-14 33

相关内容

-

上海市民办新竹园中学2020-2021学年八年级上学期期中英语试题(原卷版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOC

价格:12 积分

-

上海市闵行区2017届九年级4月质量调研(二模)英语试题及答案(word解析版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOCX

价格:12 积分

-

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(解析版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOCX

价格:12 积分

-

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(原卷版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOCX

价格:12 积分

-

上海市闵行区2018—2019学年七年级下学期期末英语试题(解析版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOC

价格:12 积分