银行外汇风险及其防范

摘要我国的人民币汇率很长一段时间是事实上的钉住美元的固定汇率制度,具有封闭性和波幅比较小的特点,在这样的环境下,商业银行的外汇风险管理一直没有受到足够的重视,风险管理水平比较落后。随着中国金融改革的不断深入汇率市场化改革也在逐步地推进,特别是在2005年7月以后,人民币汇率机制变成了“以市场供求为基础,参考一篮子货币进行调节、有管理的浮动汇率制度”,外汇汇率波动范围不断扩大。作为外汇市场的主要参与者,国内商业银行被暴露在外汇风险之下。另一方面,外汇衍生品的发展促使商业银行必须建立风险管理机制。在这样的背景下,对我国商业银行如何加强外汇风险管理能力的研究显得尤为重要。本文从外汇风险的定义出发,对...

相关推荐

-

上海市民办上宝中学2020-2021学年八年级下学期3月月考英语试题(原卷版)

2024-10-14 25

2024-10-14 25 -

上海市民办新复兴初级中学2020-2021学年九年级上学期期中英语试题(解析版)

2024-10-14 25

2024-10-14 25 -

上海市民办新复兴初级中学2020-2021学年九年级上学期期中英语试题(原卷版)

2024-10-14 29

2024-10-14 29 -

上海市民办新复兴初级中学2021-2022学年八年级下学期期中英语试题

2024-10-14 30

2024-10-14 30 -

上海市民办新竹园中学2020-2021学年八年级上学期期中英语试题(解析版)

2024-10-14 32

2024-10-14 32 -

上海市民办新竹园中学2020-2021学年八年级上学期期中英语试题(原卷版)

2024-10-14 25

2024-10-14 25 -

上海市闵行区2017届九年级4月质量调研(二模)英语试题及答案(word解析版)

2024-10-14 25

2024-10-14 25 -

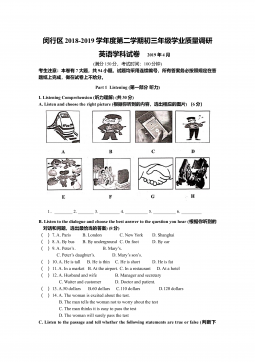

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(解析版)

2024-10-14 30

2024-10-14 30 -

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(原卷版)

2024-10-14 30

2024-10-14 30 -

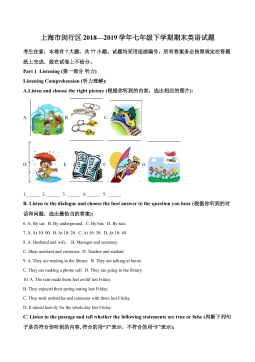

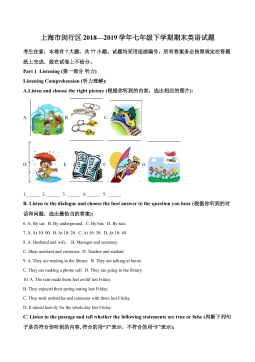

上海市闵行区2018—2019学年七年级下学期期末英语试题(解析版)

2024-10-14 33

2024-10-14 33

相关内容

-

上海市民办新竹园中学2020-2021学年八年级上学期期中英语试题(原卷版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOC

价格:12 积分

-

上海市闵行区2017届九年级4月质量调研(二模)英语试题及答案(word解析版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOCX

价格:12 积分

-

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(解析版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOCX

价格:12 积分

-

上海市闵行区2018-2019学年八年级下学期期末质量调研英语试卷(原卷版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOCX

价格:12 积分

-

上海市闵行区2018—2019学年七年级下学期期末英语试题(解析版)

分类:初中教育

时间:2024-10-14

标签:无

格式:DOC

价格:12 积分